FeaturesTravel & Expense

- ReimbursementAutomate and accelerate the entire reimbursement process

- Business TripsManage employee business trip expenses seamlessly

- Expense ManagementThe comprehensive solution to control business expenses

Manage business trips and company expenses more efficiently.View all Travel & Expense features

FeaturesSpend Control

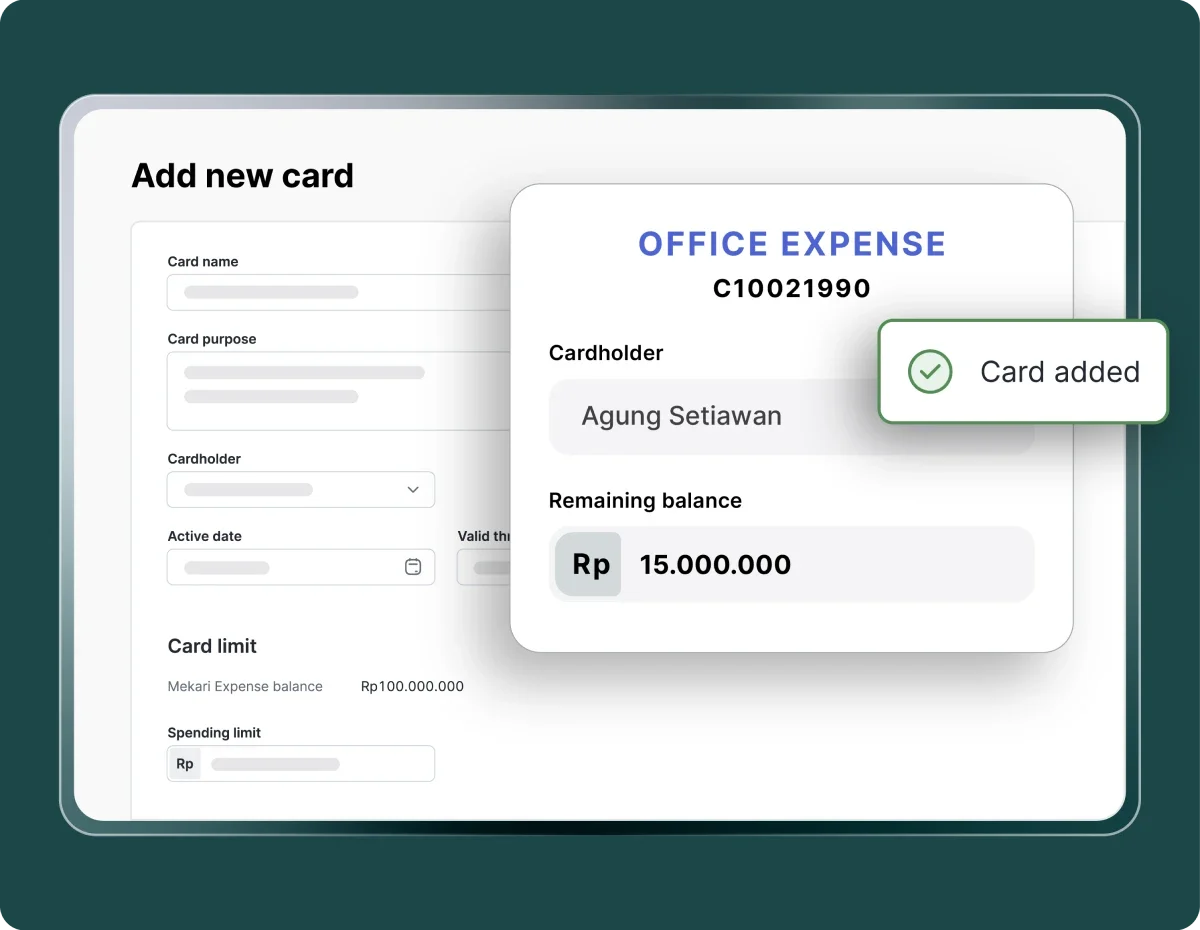

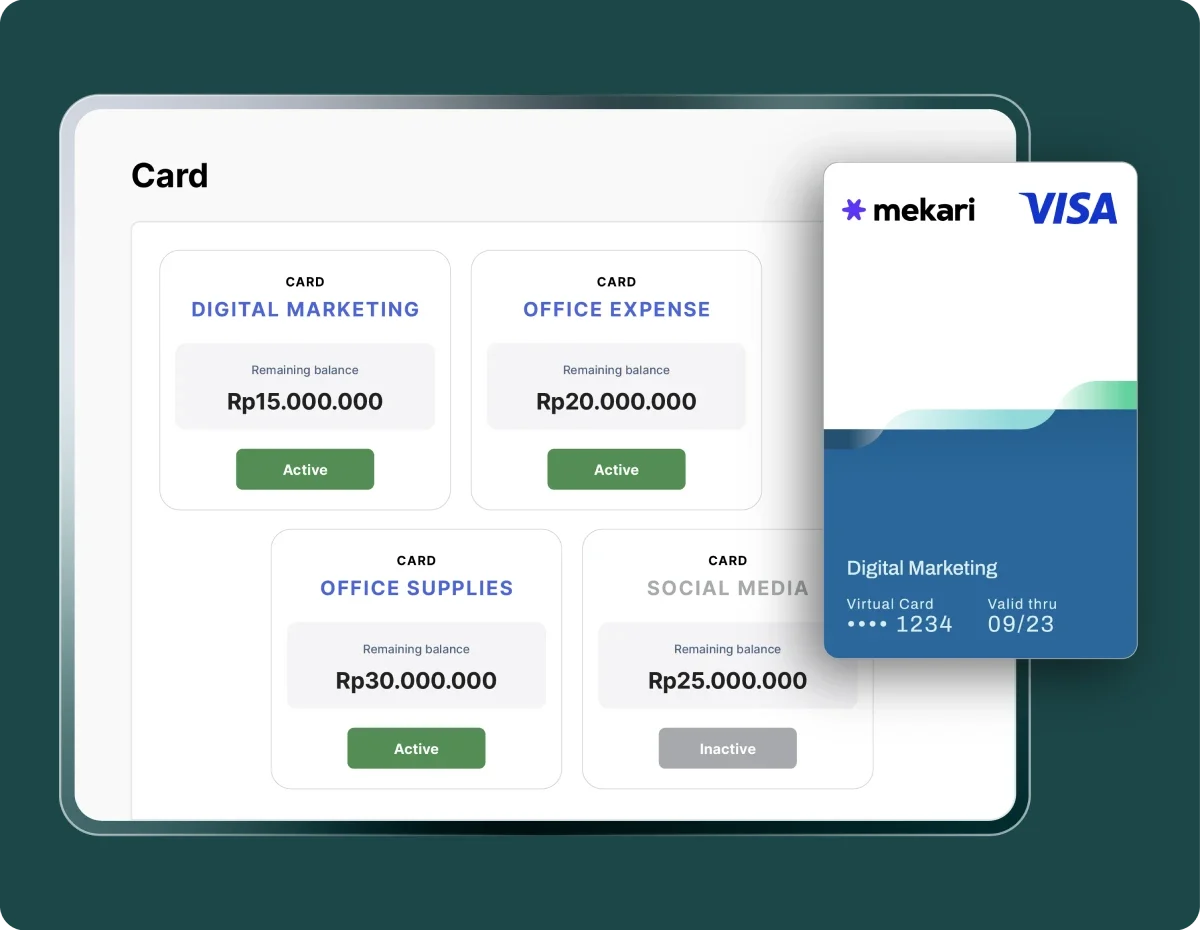

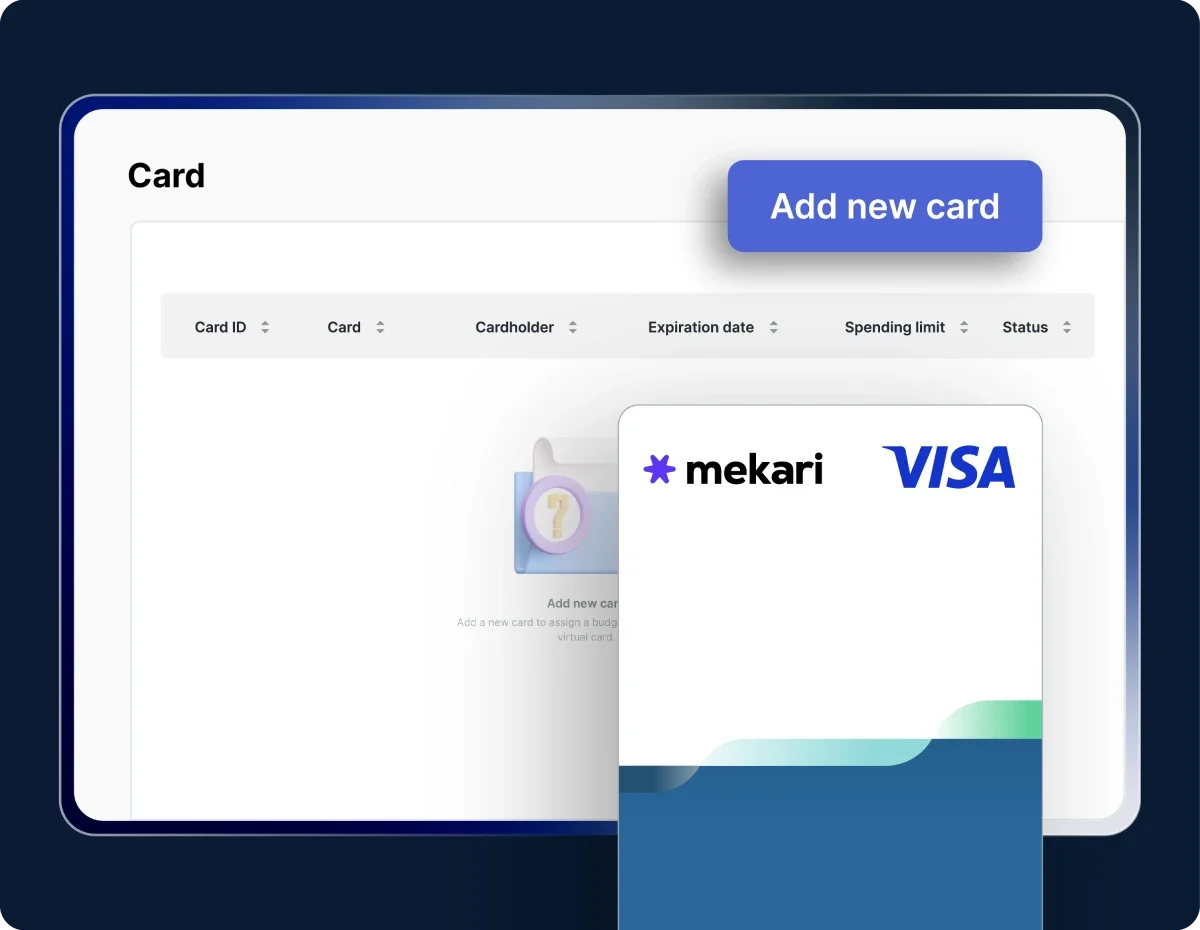

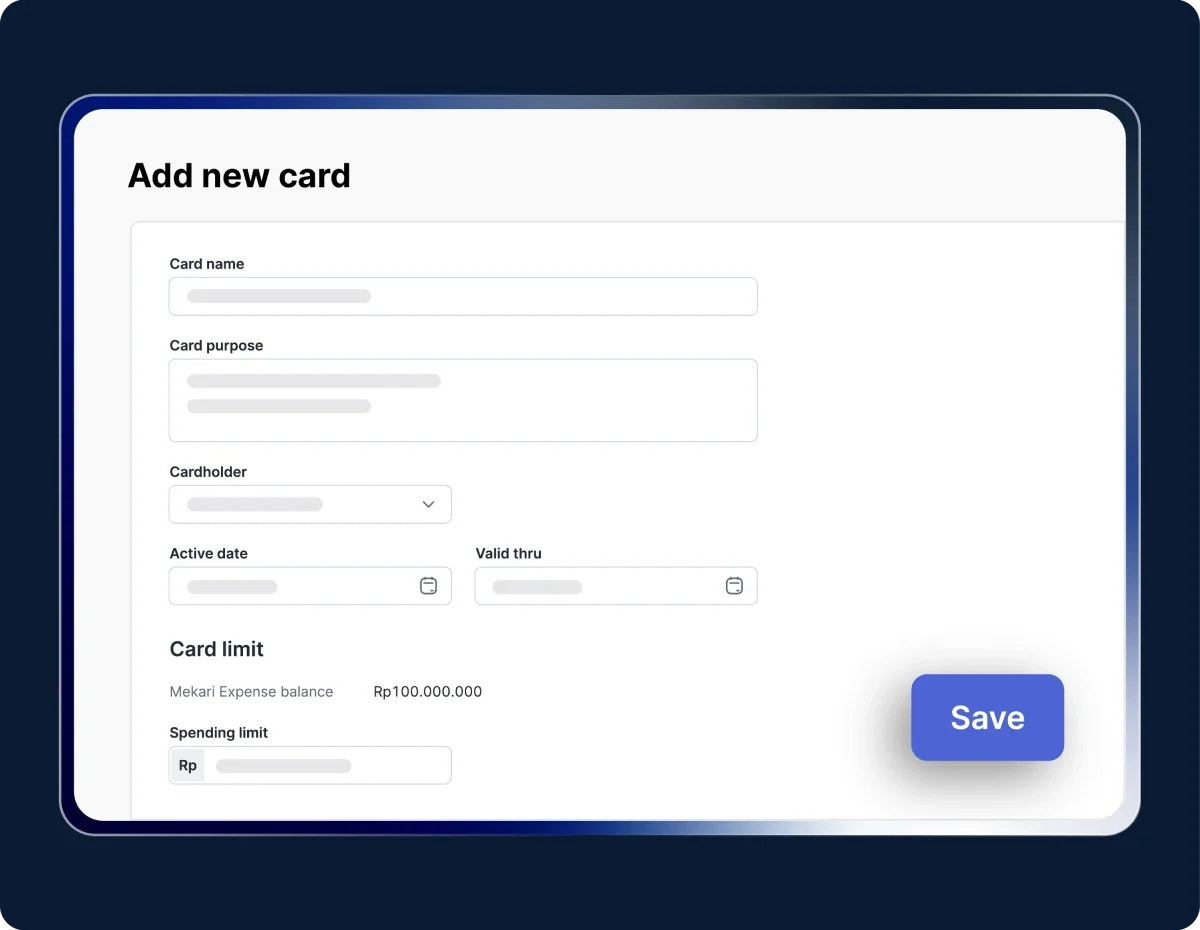

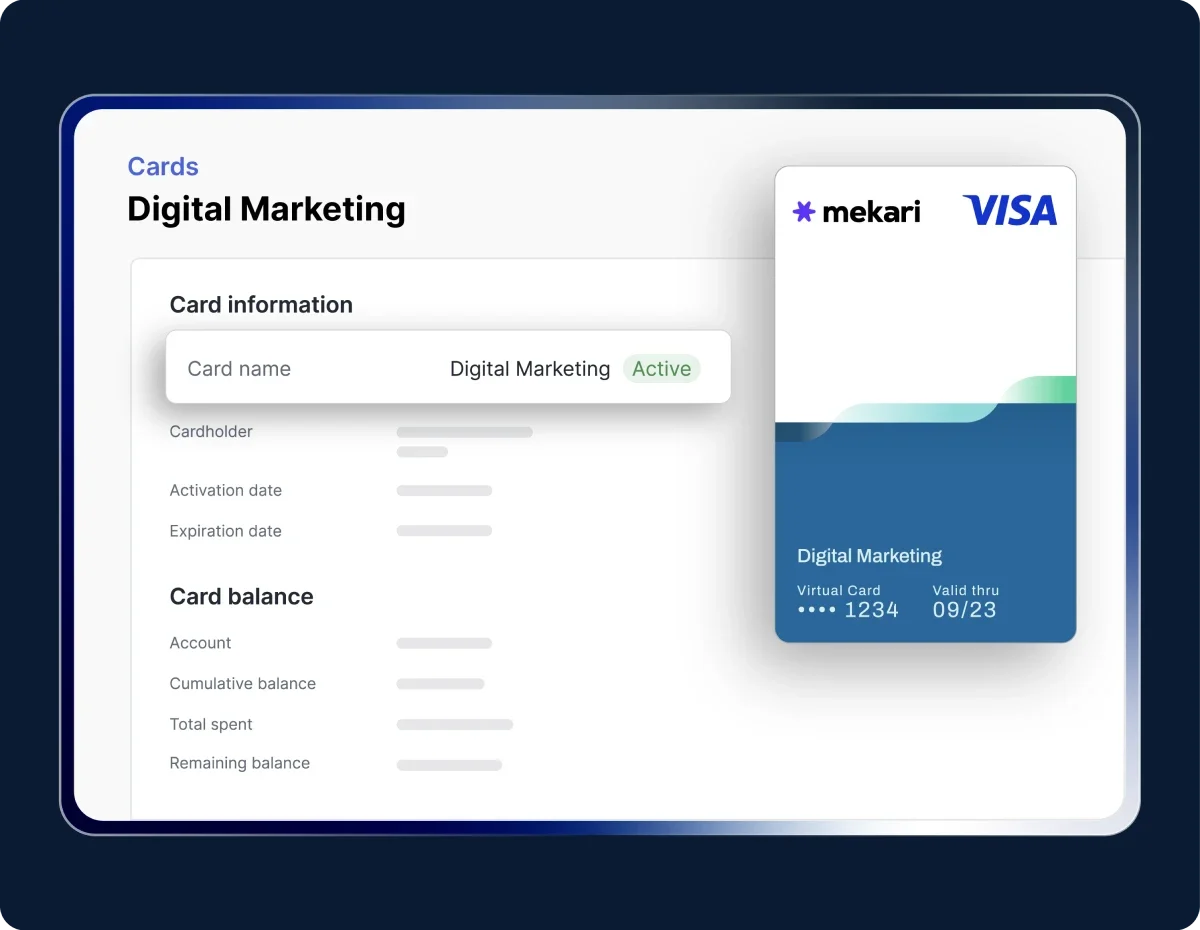

- Mekari Limitless CardCreate virtual and physical corporate cards within the app

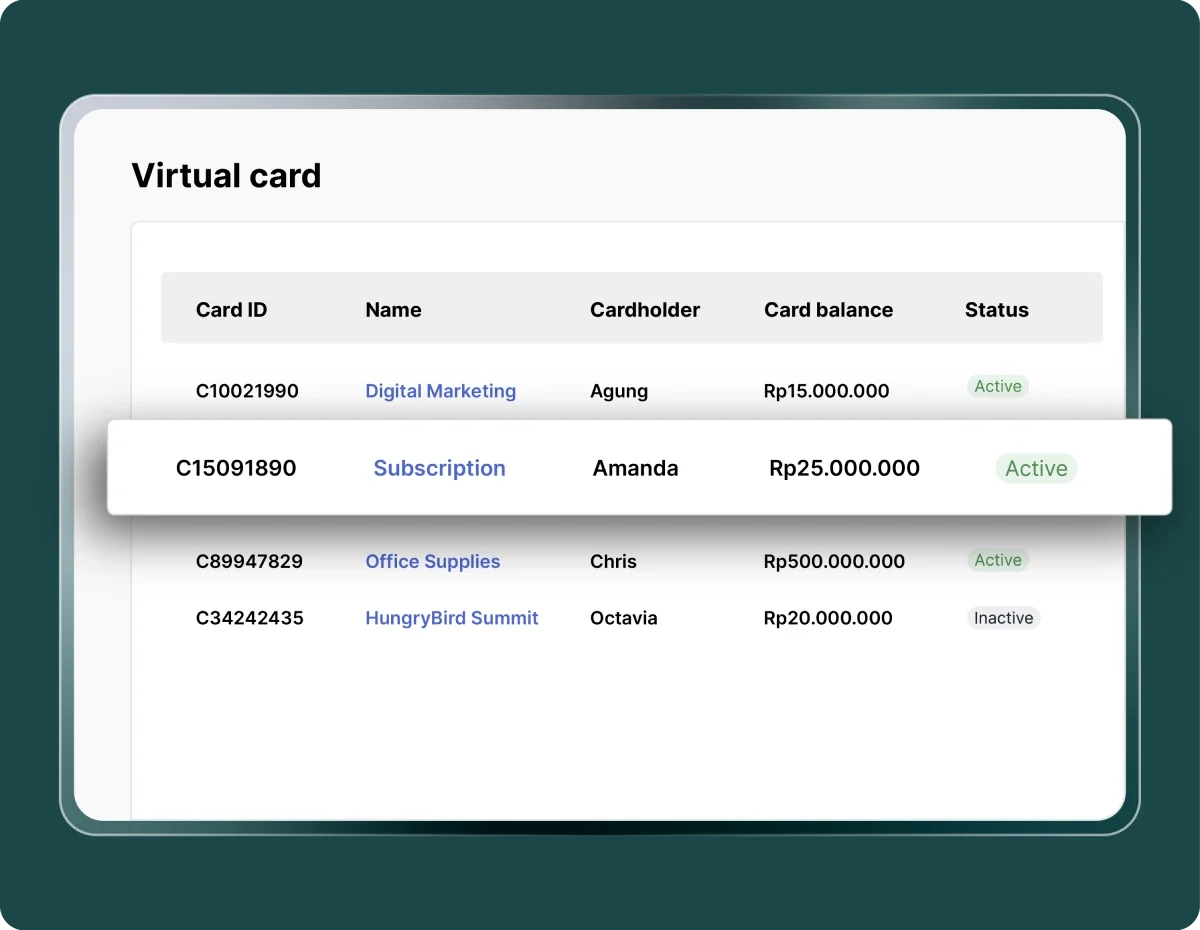

- Virtual CardEmpower employees with secure virtual cards for online spending

- Physical CardUse business debit cards for all transaction needs

- Approval AutomationStreamline and customize spending workflows flexibly

- Custom PolicyCustomize the spending policies to your needs

- Budget AllocationManage company budget allocation effortlessly

Control and automate spending policies according to your business regulations.View all Spend Control features

FeaturesAccounts Payable

- Purchase InvoiceAutomate invoicing for comprehensive procurement control

- International RemittanceSend cross-border payments fast and in real-time

- OCRConvert documents to ready-to-use data powered by OCR

Manage vendor invoices and payments in one platformView all Accounts Payable features

FeaturesProcurement

- Vendor PortalIntegrating vendors, invoices, and payments in one dashboard

- Purchase RequestAjukan permintaan pembelian dengan cepat dan terkontrol

- Purchase OrderManage vendors and purchases with automated workflows

- Product ManagementKelola produk secara terpusat dengan data akurat

- Warehouse managementSinkronkan pembelian ke gudang yang tepat agar stok selalu rapi

Manage and monitor procurement processes in a single platform.View all Procurement features