10 Best Budget Forecasting Software for Businesses

Mekari Insight

- Budget forecasting software is a digital solution that helps companies analyze historical and real-time financial data to compile more accurate budget projections based on data.

- This software makes it easier for finance teams to plan and control budgets through budget allocation and real-time visibility features, enabling faster decision-making with minimal errors.

- Mekari Expense is a local solution for businesses in Indonesia to project budgets more accurately. Through the budget allocation feature, companies can manage their budgets with real-time financial reports.

Manual budgeting estimates are a frequent source of problems. Repeated data entry, transposed numbers, and inconsistent file synchronization make it difficult for companies to plan their budgets. Therefore, to overcome this problem, software with good financial planning capabilities is needed.

Based on a 2022 survey by the Association for Finance Professionals, it was found that 52% of Financial Planning & Analysis (FP&A) departments need budget forecasting software because most of their planning and analysis still involves manual data manipulation through spreadsheets.

Through data integration and analytical features, budget forecasting software helps companies and teams develop accurate and relevant budget projections and supports strategic decision-making.

What is budget forecasting software?

Budget forecasting software is a digital solution that enables companies to analyze financial data and make more accurate financial projections. This platform helps companies and financial operations teams make data-driven financial decisions.

In general, budget forecasting software is used for several financial purposes, including:

- Predicting revenue and profits based on historical data and market trends.

- Monitoring spending patterns and improving budget accuracy.

- Running financial scenario analysis simulations (what-if analysis).

- Aligning long-term strategic goals with the company’s current financial condition.

- Supporting transparent financial reporting for management and investors.

By combining automation and analytics, this software helps finance teams accurately and quickly predict figures related to changes in market conditions.

Then, in order to be used effectively, budget forecasting generally has several important features, including:

- Data integration and consolidation: Budget forecasting software is typically connected to Accounting and HRIS systems so that all financial and operational data is centralized in one accurate source.

- AI-based automation: Improves efficiency by reducing manual tasks such as reconciliation and report preparation so that the finance team can focus on analysis, planning, and strategic decisions.

- Forecasting and scenario planning: Helps finance teams continuously update financial projections and run what-if simulations to keep budgets relevant to business changes.

- Approval workflow: Facilitates cross-team collaboration through structured approval workflows for every operational level within the company.

Baca Juga: Marketing Budget Guide: Average Allocation, Example, Strategy

Benefits of using budget forecasting tools for business

Budget forecasting software provides greater efficiency and accuracy compared to manual methods. Here are some of the benefits of using budget forecasting software in business.

- High level of accuracy: Automated data integration and validation minimize human error, enabling finance teams to produce accurate budget projections in real time and drive strategic decision-making.

- Time savings: By switching to a digital system, finance teams can quickly and accurately update financial projections or run financial scenario simulations.

- Financial visibility and control: With this software, finance teams can monitor cash flow, revenue, and operating expenses.

- Interoperability: Consolidate data from all departments through an integrated dashboard to simplify the analysis process.

- Quick decision making: This software is generally equipped with reporting features, making it easier for finance teams to make quick decisions based on data.

Recommended budget forecasting software for businesses

To support smooth budget projections, here are some recommended budget forecasting software solutions that have the capability to simplify and make decisions based on data.

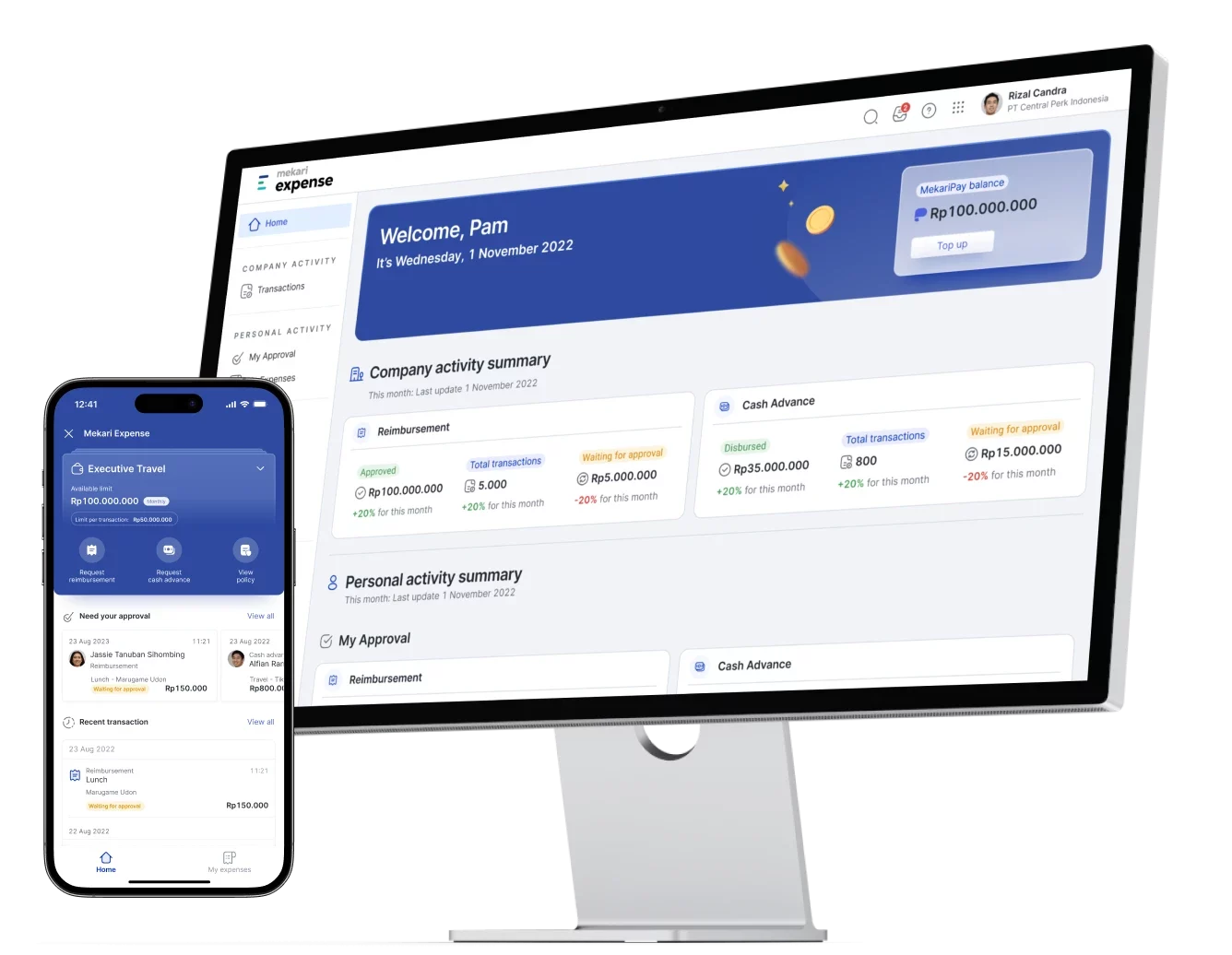

1. Mekari Expense

Mekari Expense is a spend management solution that supports budget forecasting through its spend control feature. Companies can control expenses through budget allocation, approval workflows, and setting limits on virtual and physical company cards to prevent overspending.

The Budget Allocation feature in Mekari Expense makes it easy for finance teams to categorize budgets according to business needs and monitor spending activities in real-time.

Advantages of Mekari Expense:

- Real-time visibility: Monitor cash flow and transactions through a single dashboard system and its insights.

- Budget categories: Separate the main balance into each budget category with limits that can be adjusted based on business needs.

- Company cards: Set limits and control employee spending transactions transparently with physical or digital company cards.

- Automatic payments: Set automatic and scheduled payments for each categorized bill.

- Integrated with accounting software: Mekari Expense connects with accounting software such as Mekari Jurnal to simplify the reconciliation process.

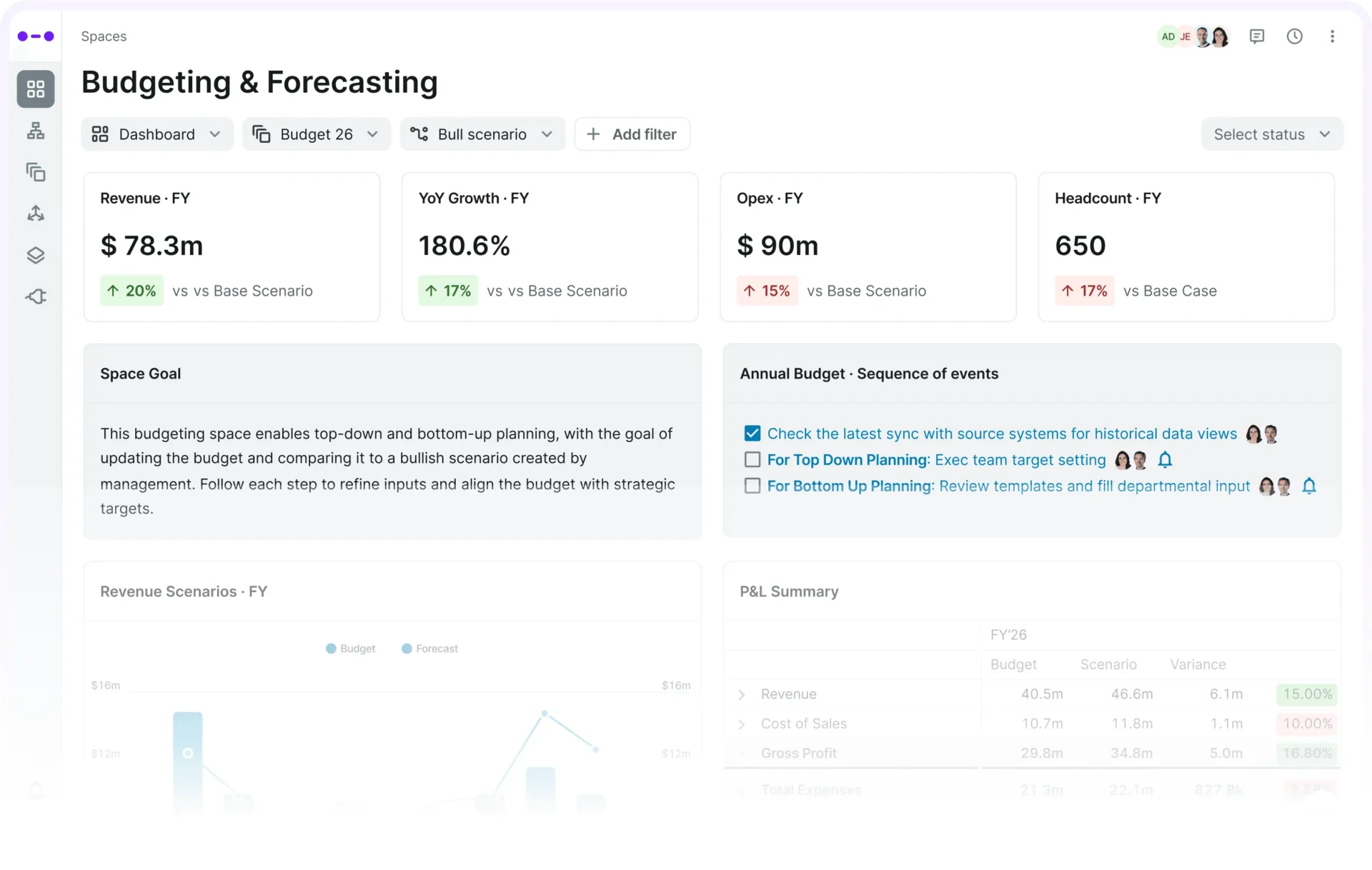

2. Vena

A financial planning platform that provides variance analysis to identify differences and financial reports in businesses. This software also has the capability to analyze the financial health of a company and process it from multiple sources.

Advantages of Vena:

- Data-based budget forecasting.

- Statistical analysis to understand business change patterns.

- Use of metrics to evaluate performance objectively.

- Easy to use because it is Excel-based.

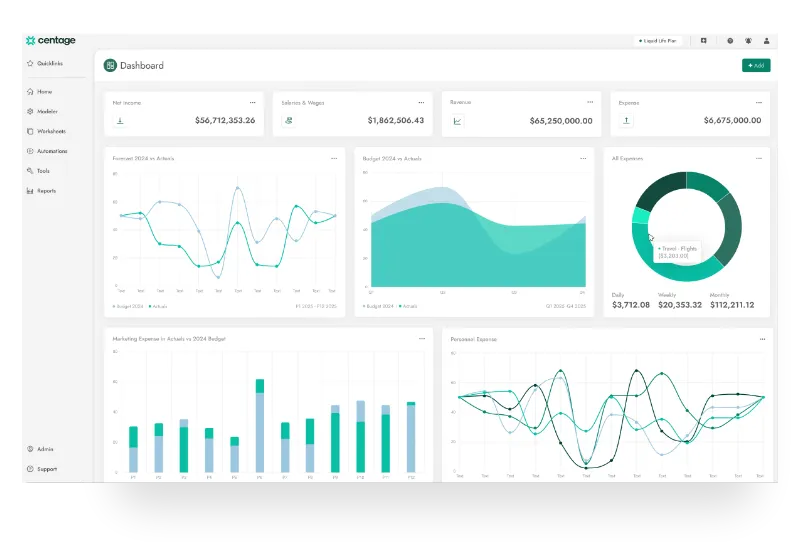

3. Centage Planning Maestro

Budget forecasting software that automates tasks prone to human error by using business logic and accounting rules. This platform can help teams within a company determine budget projections using permission-based workflows.

Advantages of Centage Planning Maestro:

- Scenario simulations to facilitate budget projections.

- Realistic multi-dimensional planning.

- Integrated and easy-to-understand dashboard.

- Flexible forecasts based on the latest data.

4. Sage

Although it is accounting software, Sage has comprehensive business budgeting capabilities. This software can be used specifically for businesses that already use their accounting systems.

Advantages of Sage:

- Integrated with the Sage accounting system.

- Functions as both an accounting tool and a budgeting analysis tool.

- Flexible scenario planning based on financial conditions.

- Financial reports in a dashboard that can be easily exported to PDF format.

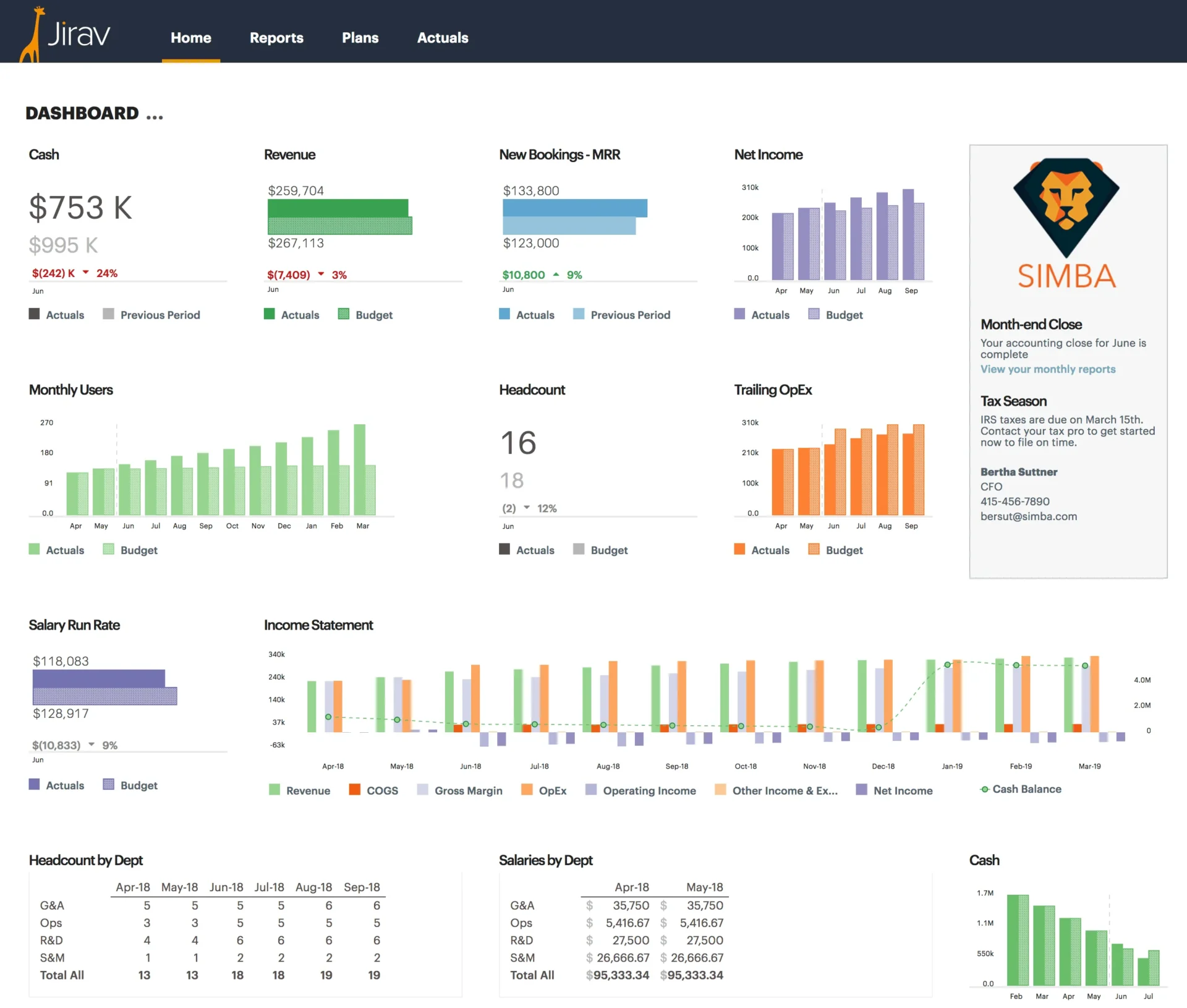

5. Jirav

Cloud-based, Jirav offers financial planning and analysis to help finance teams prepare budget estimates. Running automatically, companies can track and project budgets based on data.

Advantages of Jirav:

- Centralized and integrated financial data in one system.

- Accurate data-based forecasts.

- Easy tracking of business performance in the dashboard.

- Accompanied by graphical visualizations to make reports easier to read.

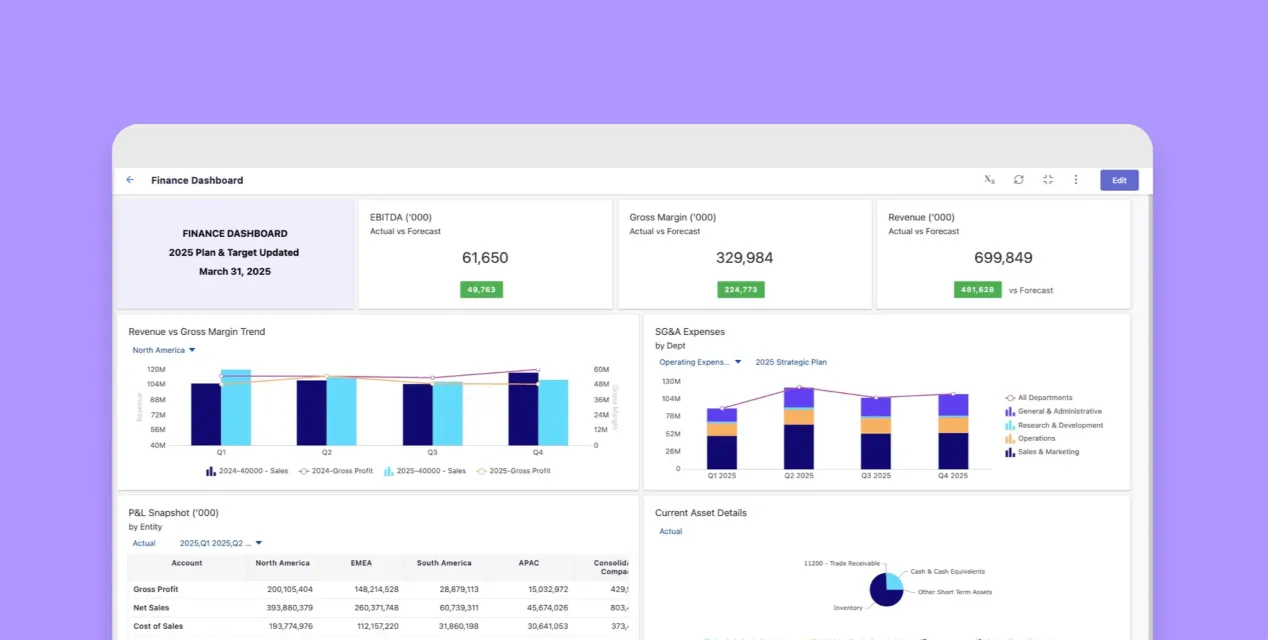

6. Planful

Planful is budget forecasting software that helps companies minimize costs and save time. It allows companies to view financial data in real time and supports employee productivity.

Advantages of Planful:

- Real-time visibility in a unified dashboard.

- More adaptive cash planning based on the company’s financial condition.

- Financial analysis reports to see spending patterns.

- Structured financial strategies with long-term planning templates.

7. Abacum

A budget forecasting platform that simplifies financial decision-making by combining budgets and forecasting based on historical data. With accurate data sources, companies can analyze comprehensive budget plans.

Advantages of Abacum:

- Promotes an efficient company budget cycle.

- Sets accurate vendor budgets.

- Approval workflow

- Real-time visibility in the dashboard.

8. Planguru

A practical choice for businesses that want to make faster financial decisions. With its analytics feature, companies can estimate budgets in each department more simply.

Advantages of Planguru:

- Long-term and mature budget planning.

- Automatic integration without having to manually input data from separate systems.

- What-if analysis to help companies understand the impact of financial changes.

- Setting budget limits according to business needs.

9. IBM Planning Analytics

IBM helps businesses collect and analyze financial data to support their budget forecasting needs. AI-based, this platform can help every department manage and develop financial goal strategies.

Advantages of IBM Planning Analysis:

- Accurate forecasting thanks to AI.

- More objective performance monitoring with scorecards.

- Can be combined with Excel.

- Real-time insights with a user-friendly display.

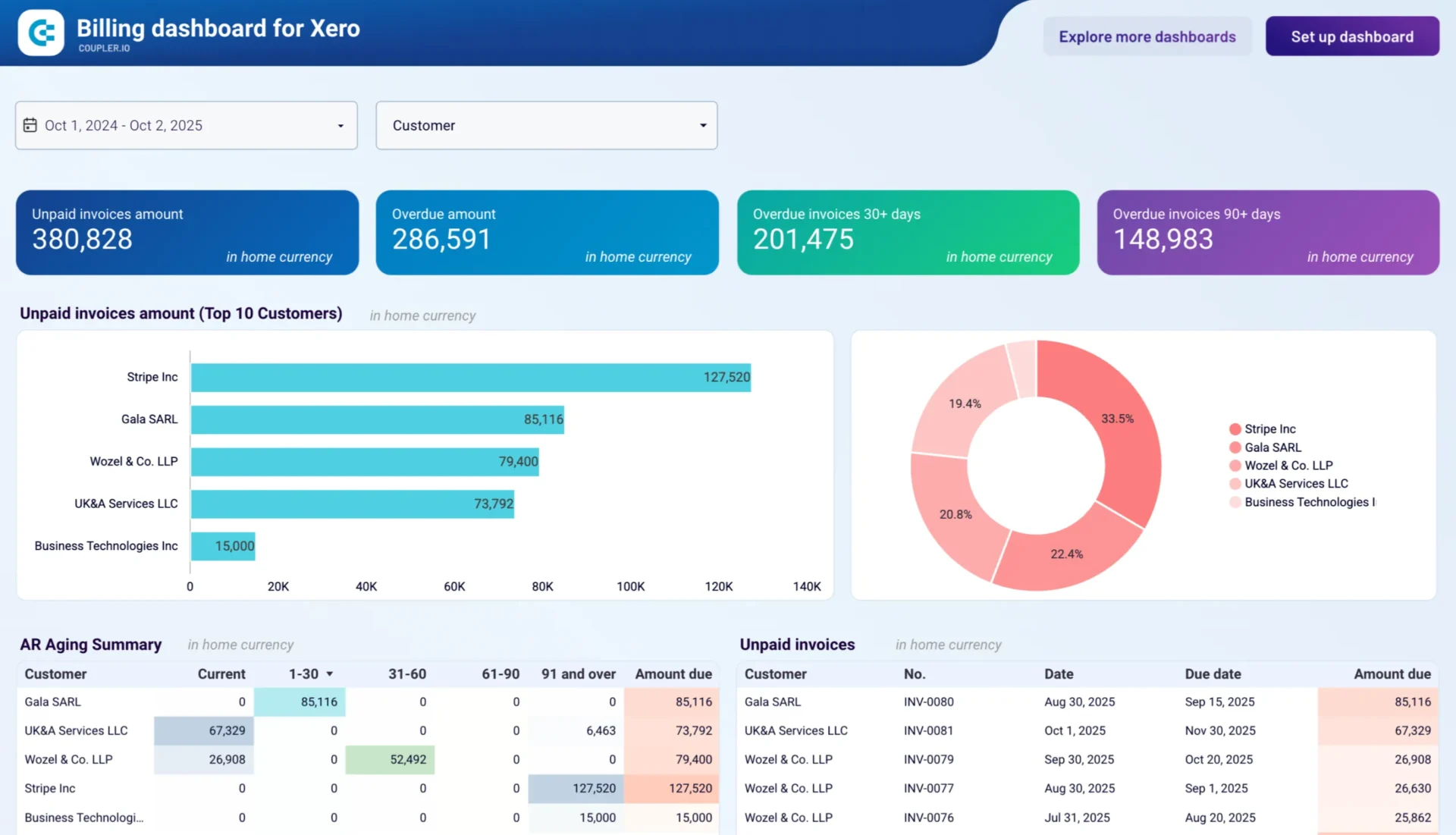

10. Xero

Cloud-based, Xero is known for its reliable forecasting capabilities. This software provides efficient features for managing finances and simplifying the budget project process.

Advantages of Xero:

- More controlled budget creation and monitoring.

- Real-time insights for finance teams.

- Set budgets based on business needs.

- Accurate budget performance reports to facilitate the analysis process.

Baca Juga: 7 Best Expense Management Software with Accounting Integration

Best budget forecasting software for businesses in Indonesia

Budget forecasting software is a business tool for developing more accurate, adaptive, and transparent financial budget planning. With real-time visibility, companies can monitor and anticipate the risks of change based on business financial conditions.

As a spend management solution, Mekari Expense is here to help every business in Indonesia, especially finance teams, to project budgets and make financial decisions accurately and precisely.

With the Budget Allocation feature, companies can:

- Categorize budgets separately with adjustable limits.

- Easily track transactions using physical and virtual employee cards that are directly connected to the Mekari Expense system.

- Set up scheduled payments for each categorized bill.

- Easily manage claim submissions by department or project with an accurate and transparent process.

With strict budget control, companies can not only estimate budgets, but also control them to avoid overspending.

Build a more accurate and structured budget management system with budget forecasting software, and learn how Mekari Expense can support smarter business decisions!

Reference

Jedox. “7 key benefits of integrating budgeting and forecasting software”.

FAQ

What is budget forecasting software?

What is budget forecasting software?

Budget forecasting software is a digital solution that helps companies analyze financial data and compile more accurate budget projections based on historical and real-time data.

When and who uses budget forecasting software?

When and who uses budget forecasting software?

Budget forecasting software is used regularly by finance, FP&A, and operational management teams to monitor budgets, project expenses, and support business decision-making.

What is the difference between budget forecasting and traditional budgeting?

What is the difference between budget forecasting and traditional budgeting?

Traditional budgeting is done manually, while budget forecasting is integrated into the system, continuously updated, and adjusts projections to changes in business conditions.

How does Mekari Expense support corporate budget forecasting?

How does Mekari Expense support corporate budget forecasting?

Mekari Expense supports budget forecasting through its budget allocation feature, real-time expense monitoring, and customizable budget policies. With comprehensive visibility, companies can project and control their budgets more accurately.